capital gains tax increase 2021

It also includes income thresholds for Bidens top rate proposal and the 38 NIIT. Some information may no longer be current.

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

The proposal would increase the maximum stated capital gain rate from 20 to 25.

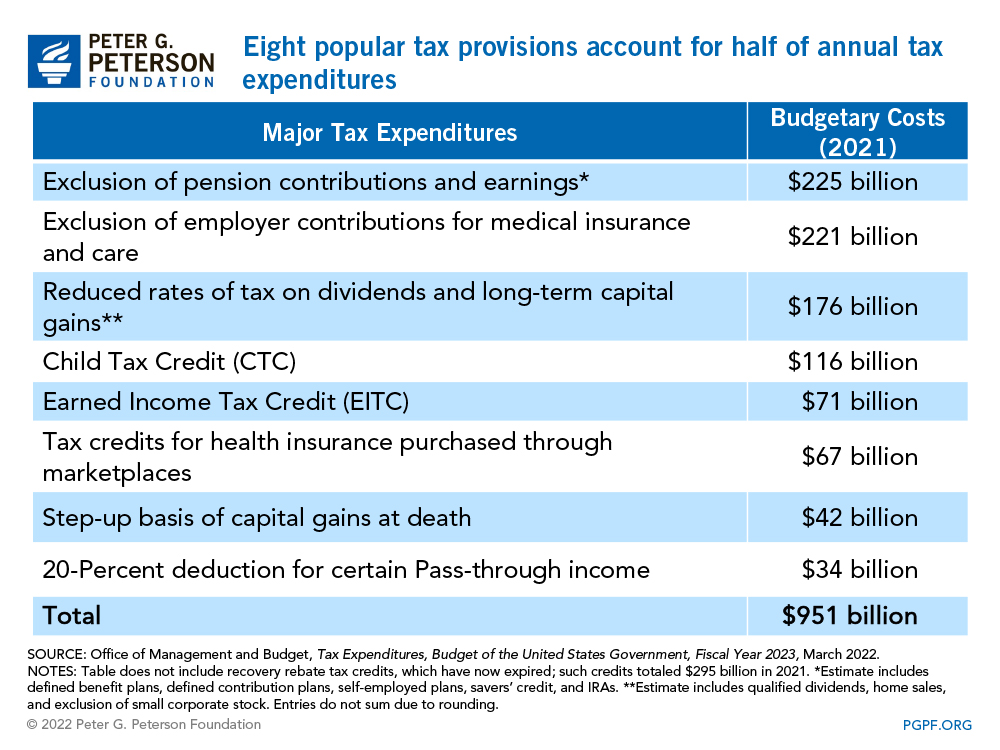

. The chart below illustrates how the change in capital gains tax rates affects the sellers net proceeds. The current tax preference for capital gains costs upwards of 15 billion annually. To address wealth inequality and to improve functioning of our tax system tax rates on capital gains income should be increased.

Once fully implemented this would mean an effective federal. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

Capital Gains Tax Rates 2021 To 2022. Ad The Leading Online Publisher of National and State-specific Legal Documents. The effective date for this increase would be September 13 2021.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. 2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe. Thats 50 more funds predicted to make large taxable distributions of more than 10.

The table below breaks down long-term capital gains tax rates and income brackets for tax year 2021. Ad Browse discover thousands of unique brands. Its time to increase taxes on capital gains.

But because the higher tax rate as proposed would only. This included the increase of GT rates so they were more similar to income tax which was a big problem for anyone looking to sell property. Weve got all the 2021 and 2022 capital gains tax rates in one.

House Build Back Better Act. Taxing capital gains at ordinary income tax rates would bring the combined top marginal rate in the US. Posted on January 7 2021 by Michael Smart.

Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. And CapGainsValet predicts 2021 will see more than double the historical average of funds making distributions of more than 10. But in 2020 with very good market performance and continued mutual fund outflows 2021 is expected to be much more significant.

Details Analysis of Tax Provisions in the Budget Reconciliation Bill Dec. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. Or sold a home this past year you might be wondering how to avoid tax on capital gains.

They also wanted to remove a tax-free uplift on death for inherited assets which would have reduced benefit to farmers who hung onto assets and gave them to. The gross tax increase would be reduced on a net basis by increases in tax credits for certain. Get Access to the Largest Online Library of Legal Forms for Any State.

History is a good indicator of the impact of a capital gains increase on MA in the insurance agent and broker market. Read customer reviews best sellers. Published January 12 2021Updated February 9 2021.

To evaluate we looked back to 2012 when capital gains rates increased from 15 to 20 on Jan. Makes a capital gains tax increase more likely. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

This article was published more than 1 year ago. President Biden will propose a capital gains tax increase for households making more than 1 million per year. This tax increase applies to high-income individuals with an AGI of more than 1 million.

Connect With a Fidelity Advisor Today. These taxpayers would have to pay a tax rate of 396 on long-term capital gains. The top rate would jump to 396 from 20.

These changes may hit homeowners looking. The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396. Ad Make Tax-Smart Investing Part of Your Tax Planning.

The top rate would be 288 when. Short-term gains are taxed as ordinary income. Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times Capital Gains Taxes Explained Short Term Capital Gains Vs.

Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Ad If youre one of the millions of Americans who invested in stocks. Under Bidens proposal all taxpayers making more than 1 million in long-term capital gains would have to pay the 396 rate in addition to the 38 NIIT.

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Capital Gains Tax Rates By State Smartasset

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How Do Marginal Income Tax Rates Work And What If We Increased Them

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

2022 Capital Gains Tax Rates By State Smartasset

Crypto Tax Uk Ultimate Guide 2022 Koinly

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

How Much Tax Will I Pay If I Flip A House New Silver

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

Canada Capital Gains Tax Calculator 2022

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca